The Great ConsolIdation

A Case Study on Industry Transformation

Categories

Branding, Web Design

Client

Arden & Co.

Project

Project Echo

Services

Branding

Art & Design Direction

Motion

Web design

Year

2025

A Case Study on Industry Transformation

Categories

Branding, Web Design

Client

Arden & Co.

Project

Project Echo

Services

Branding

Art & Design Direction

Motion

Web design

Year

2025

Introduction: The $13 Billion Funeral

On November 26, 2025, Omnicom closed its acquisition of Interpublic Group for $9 billion down from the originally announced $13.5 billion, because nothing says 'strategic synergy' quite like a 33% haircut. The deal created the world's largest advertising holding company, a Voltron of agencies with combined revenues exceeding $25 billion. But here's the thing nobody wants to talk about at the merger party: IPG, the first-ever advertising holding company founded in 1930, basically ceased to exist. Poof. Gone. Ninety-five years of history absorbed into the borg.

And with it went DDB….yes, that DDB, winner of network of the year at Cannes Lions in 2024, the agency that gave us 'Think Small' and the Volkswagen revolution. Also, FCB, which traces its lineage to 1873, making it older than the telephone. Also: MullenLowe. All three creative networks eliminated, folded into TBWA and BBDO like origami birds crushed in a briefcase.

The body count? Around 10,000 jobs eliminated—roughly 8% of the combined workforce. IPG alone shed 3,200 positions in nine months leading up to the merger. Omnicom had already trimmed 3,000 by year-end 2024. Another 4,000 got the axe post-close. The merged entity now employs about 105,000 people, down from 128,000 just a year earlier.

This isn't a case study about a merger. It's an autopsy of an industry that spent decades consolidating, optimizing, and financializing creativity and is now finding out what happens when you treat art like soybeans.

How We Got Here: A Brief History of Eating Your Own

Advertising agencies weren't always megacorps. In 1869, a 21-year-old named Francis Wayland Ayer invented the modern agency model with one radical idea: work for the advertiser, not the newspaper. His N.W. Ayer & Son pioneered the 'open contract', the agency would negotiate the best media prices for clients and take a 15% commission. Suddenly agencies had skin in the game. They had to make ads that actually worked, which meant hiring copywriters, art directors, strategists. The creative revolution had begun.

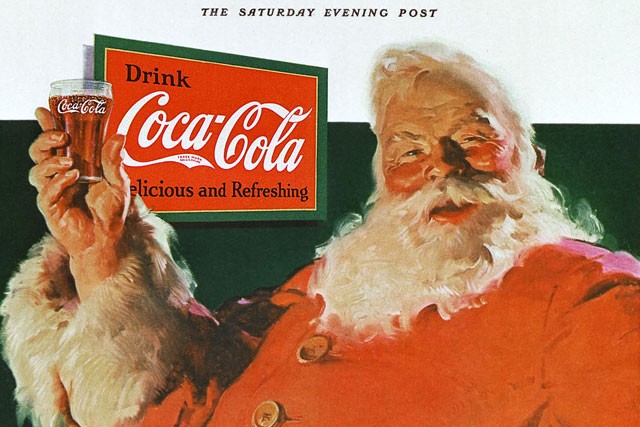

Fast forward to the 1960s and 70s. Giants like Coca-Cola and Unilever went global, and their agencies had to follow. You couldn't service Procter & Gamble from a single Manhattan office anymore; you needed boots on the ground in London, Tokyo, São Paulo. This triggered the first wave of M&A in the 70s, 80s, and 90s—the birth of holding companies.

The logic was elegant: One corporate parent (WPP, Omnicom, Publicis, IPG) owns a portfolio of specialized agencies—creative shops, media buyers, PR firms, research companies. Clients get a one-stop global network. Shareholders get economies of scale. Agencies get acquired at prices they couldn't achieve independently.

Then came the internet. The 1990s and 2000s shattered the old model. A 15% commission on a $50 Google AdWords click? Worthless. Clients started hiring specialists: a digital agency for the website, a performance shop for paid search, and an influencer house for TikTok. The full-service model crumbled. Margins compressed. Growth stagnated.

By 2024, IPG's creative agencies were down 4.1% organically. Revenue at WPP's integrated creative shops dropped 1.1% in Q3. The industry was treading water, and consolidation became the only growth story left. If you can't grow revenue, you cut costs. If you can't cut costs alone, you merge.

Challenge: The Five Horsemen of the Adpocalypse

Why did this happen now? Why did two bitter rivals—companies that spent decades trying to out-pitch each other—suddenly decide the best move was to eliminate half their brands and fire 10,000 people? Five forces converged:

1. The Profitability Crisis

Traditional agency economics are broken. Clients squeezed fees. Pitching became high-frequency, low-value. IPG lost three of its biggest creative accounts—General Motors, Amazon, Verizon—in 18 months. The pressure to deliver 'savings' became existential. The merger promised $750 million in annual cost synergies, and Wall Street demanded them yesterday.

As one industry observer noted, holdcos needed to 'grow—and mega-consolidations present cost-cutting opportunities that are too tempting to pass up.' Translation: They couldn't make money the old way, so they'd make it by eliminating redundancies. Your job is now a redundancy.

2. The AI Arms Race

Omnicom's pitch for the merger leaned heavily on AI. The combined company would have enterprise-grade generative AI capabilities—integrating Omnicom's 'Omni' platform with IPG's Acxiom data trove. In practice, this meant automating creative production, media optimization, and campaign personalization at scale. AI can churn out hundreds of ad variations in minutes. Clients love it. Creatives? Well, you don't need as many of them.

The industry is unanimous: AI will reshape everything. But agencies need capital to build AI infrastructure. Omnicom CEO John Wren claimed all teams would now have access to 'advanced AI tools.' The subtext: We need fewer humans because the robots got really good.

3. The Consultancy Invasion

By 2017, Accenture Interactive was the world's sixth-largest ad agency. In 2019, it bought Droga5, one of the most awarded creative shops in the world. McKinsey, Deloitte, PwC—they all built marketing practices. Why? They had something agencies didn't: board-level relationships, data analytics at scale, and balance sheets that could absorb losses while agencies scrambled for 15% margins.

Holding companies had to respond. If you can't beat the consultancies on data and technology, at least get big enough to compete on buying power and global reach. Hence: megamerger.

4. The Walled Garden Problem

Google, Meta, Amazon—these platforms don't just sell ads; they control the entire stack. Media planning, targeting, creative optimization, attribution. Agencies went from being intermediaries to being optional. In 2024, digital advertising spend surpassed $1 trillion globally. Most of it went straight to platforms, bypassing agencies entirely.

The merger gave Omnicom massive media buying leverage. As one analysis put it, the combined entity has 'notable control over media buying' that 'could reshape the competitive landscape.' Scale became the only moat left.

5. The Death of Legacy

Here's the existential crisis nobody wants to name: Legacy doesn't pay the bills anymore. DDB was 76 years old. FCB was 152 years old. MullenLowe had decades of award-winning work. And yet, when Omnicom drew up its post-merger org chart, all three got the axe. Alex Lubar, DDB's global CEO, resigned before the merger even closed, fueling speculation the agency would be dissolved.

Andrea Cook, former global innovation officer at McCann, captured the mood: 'I hate this expression. Behind every 'darling' being 'killed' are humans and hard-won specialisms our industry can't afford to lose.'

The message is clear: If you don't generate growth or cost savings, your history is irrelevant. Your Cannes Lions are irrelevant. Your founding year is a fun trivia question, not a business case.

Why Creativity Isn't Dead

Creativity isn't dead. The way we package and sell it for corporate work is evolving, and if you're smart, you're already ahead of the curve.

The Omnicom-IPG merger isn't the death of creativity—it's the death of bloated, overlapping, redundant creative bureaucracy. The industry isn't disappearing; it's unbundling. And in that unbundling, there's opportunity.

Go Independent or Go Niche

The middle is disappearing. As one report put it, '2026 will likely see the middle of the market disappear, leaving only the massive consolidated giants and the nimble, hyper-specialized experts.'

Independent agencies are having a moment. In 2025, indies reported stacked pipelines, new business growth, and talent fleeing the holding companies. Why? Because clients are tired of account teams that change every six months, generic decks recycled across pitches, and layers of bureaucracy. Independents offer speed, authenticity, and undivided attention.

Data backs this up: 79% of agencies said Connected TV (CTV) unlocked new business opportunities. Nearly 60% said CTV grew their client base. Translation: Technology democratized capabilities once reserved for mega-holdcos. A five-person shop in Austin can now run sophisticated programmatic campaigns, thanks to tools like MNTN and AdCreative.ai.

The indie playbook:

• Specialize ruthlessly. Don't be a full-service agency. Be the DTC growth shop, the B2B content machine, the influencer performance experts.

• Own your tech stack. Use AI for efficiency (creative scoring, predictive analytics) but differentiate on human strategy and taste.

• Build client relationships, not RFPs. The holdcos are distracted with integration chaos. Poach their frustrated clients.

Embrace First-Party Data and Retail Media

Third-party cookies are dying (for real this time). The walled gardens (Google, Meta, Amazon) own identity and attribution. What's left for agencies? First-party data strategies and retail media networks.

Walmart bought Vizio for $2.3 billion to build a connected TV and retail media empire. Experian acquired Audigent to dominate CTV identity. Every retailer with a loyalty program is launching an ad network. These closed-loop ecosystems deliver what advertisers crave: attribution, conversion data, and no media waste.

Agencies that help brands navigate retail media—building campaigns for Amazon DSP, Walmart Connect, Target Roundel—are printing money. The brands still stuck buying TV spots and banner ads? They're getting disrupted.

Prioritize Culture and Humanity (Because Robots Can't)

Here's the thing the spreadsheet jockeys always miss: Advertising is culture work. The best campaigns—Nike's 'Just Do It,' Apple's '1984,' Dove's 'Real Beauty'—aren't optimized media buys. They're cultural moments. They shift how people think and feel. THERES literally nothing better than human connection

AI can't create cultural resonance. It can mimic patterns, remix aesthetics, optimize performance. But it can't understand why a meme lands, why a tagline becomes a rallying cry, why a visual metaphor cuts through the noise. That's human work—taste, judgment, empathy, context.

As one agency head observed, 'If we don't fight the blandification of 2024, it's all just a race to the bottom.' The counter-move: Lean into humanity. Tell stories that matter. Take creative risks. Build brands, not just campaigns.

The culture playbook:

• Hire for taste, not just technical skills. Cultural fluency can't be automated.

• Champion bold creative. Use AI for efficiency, but reserve big swings for human creatives.

• Build inclusive, diverse teams. Different perspectives = differentiated work. Homogenous teams produce generic output.

AI is reshaping the work, but it's not replacing the workers—yet. The key insight: AI handles the grunt work (A/B testing creative variations, optimizing bids, analyzing sentiment), freeing humans to focus on what robots can't do—strategy, taste, cultural insight, big ideas.

As one industry strategist put it, 'AI is no longer a futuristic concept—it's the foundation of high-performance advertising in 2025. Brands that leverage AI for creative generation, creative performance prediction, and programmatic advertising will dominate.'

But—and this is critical—AI is producing a sameness problem. Every shop using the same generative tools outputs variations on the same aesthetic. The brands that break through? They use AI for speed, then layer in human curation, cultural context, emotional intelligence. As Harvard's marketing program notes, 'Human oversight is essential to maintain trust, authenticity, and ethical use of data.'

The AI playbook:

• Use AI for creative scoring and predictive performance (e.g., AdCreative.ai's 90%+ accuracy in predicting winners).

• Automate media buying and optimization, but reserve strategic decisions for humans.

• Train your team. Everyone needs to understand what AI can and can't do. The agencies that treat AI as a black box will get eaten by the ones that understand it.

The Omnicom-IPG merger looks like consolidation, but it's actually the opposite. It's the beginning of the great unbundling. The holding company model—one parent owning dozens of agencies offering 'integrated solutions'—is collapsing under its own weight.

What replaces it? A fragmented, specialized, technology-enabled ecosystem where clients mix and match partners based on need. A brand hires a boutique creative shop for the big idea, a performance agency for paid media, a consultancy for strategy, an AI platform for production at scale. No one entity owns the whole stack anymore.

This is terrifying if you're a holding company trying to justify overhead. This is liberating if you're a talented creative trying to do great work.

The industry isn't dying. It's evolving. And evolution rewards the fast, the specialized, the culturally fluent, the technologically savvy. It punishes the bloated, the bureaucratic, the legacy-obsessed, the change-resistant.

The Omnicom-IPG merger is a watershed, but not for the reasons the press releases claimed. It's not about creating the world's most powerful marketing company or unlocking AI-driven synergies or building integrated full-funnel solutions. It's about the end of an era. The era when advertising agencies were the center of gravity for brand-building. The era when creative shops commanded premium fees for strategic counsel. The era when a 152-year-old agency name meant something to someone who mattered.

That era is over. IPG is gone. DDB, FCB, MullenLowe—retired. Ten thousand jobs eliminated. Another wave of layoffs is coming as integration continues through 2026. The survivors will be absorbed into Omni's nine 'Connected Capabilities,' which is corporate-speak for 'we don't need distinct brands anymore, just billable units.' But here's what the consultants and the CFOs and the efficiency experts always miss:

Creativity doesn't die. It just moves.

It moves out of the holding companies and into independent shops. It moves out of agencies altogether and into brands' in-house teams. It moves into consultancies, production studios, influencer collectives, software companies with creative teams. It fragments, specializes, unbundles.

The best talent fleeing Omnicom and IPG aren't retiring. They're starting their own shops. Richard Brim and Martin Beverley (formerly of adam&eveDDB) launched a new startup with Polly McMorrow (McCann London). Alex Lubar resigned before DDB's dissolution, presumably to build something new. The entire FutureBrand executive team exited days before the EU approval. These aren't endings…they're beginnings.

Meanwhile, independent agencies are booked solid. CTV democratized capabilities. AI leveled the playing field. Clients want partners, not vendors, and small shops can deliver what the megacorps can't: attention, agility, authenticity. I also reccomend you check out this article. https://www.linkedin.com/pulse/when-agencies-delete-themselves-ercole-egizi-8d9kf